While 2020 was a difficult year for many people in many respects, it turned out to be another strong year in financial markets. Despite the Covid-19 pandemic which ground the global economy to a halt in March and drove precipitous declines in global equity markets, most major asset classes generated positive and relatively strong returns for the year. Moreover, many of the key global equity indices finished the year at or near record highs.

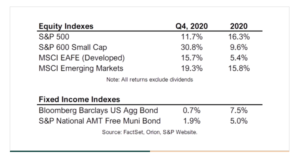

Within equity markets, U.S. stocks (as measured by the S&P 500 Index) led the way once again with a 16.3% gain (excluding dividends), bringing the two-year gain to nearly 50%. This is the largest two-year gain since 1999. Emerging market equities also performed well, finishing up 15.8% for the year, while foreign developed equities and the shares of smaller companies continued to be relative laggards. Notably, foreign stocks and small company stocks outperformed the S&P 500 in the fourth quarter, suggesting we may be in the early stages of a rotation in the markets heading into the new year.

Fixed income markets also turned in surprisingly strong results. Despite a 1.9% yield on the 10-year Treasury bond at the beginning of 2020, U.S. bonds, as measured by the Bloomberg Barclays Aggregate Bond Index, were up 7.5% for the year. That very strong result was driven by the sharp decline in interest rates throughout the year, as bond prices rise when interest rates fall (and vice versa). Credit spreads (the incremental yield above ‘risk-free’ government bonds) on riskier bonds widened significantly during the pandemic-driven sell-off in March and April but rallied dramatically along with equity markets and finished the year near 15-year lows for most fixed income sectors.

As we head into the new year, an assessment of economic and financial conditions presents a very mixed picture. The biggest positive right now is on the policy front, as an unprecedented level of fiscal and monetary support has helped stimulate economic activity, kept interest rates very low and injected significant liquidity into the system. With the Fed and the Treasury working together in unprecedented ways (and the Treasury set to be led by previous Fed Chair Yellen), we expect financial conditions to remain loose and supportive of markets for the foreseeable future.

The approval and roll-out of the first two Covid-19 vaccines is also a material positive as it should bring down fatalities related to the virus and gradually bring the global health crisis under better control. This should enable sectors of the economy that have been hardest hit by the pandemic to ‘reopen’ and begin to drive economic growth once again.

While the economy has surged off its second quarter lows (the worst quarterly GDP report on record), it remains far below 2019 levels. Thus far, the economy has recovered roughly 12 million of the 22 million jobs that were lost in the early stages of the pandemic. Corporate earnings have followed a similar pattern with second, third and fourth quarter earnings falling 49%, 33% and 5%, respectively. Although analysts are expecting profits to recover in 2021, we note that past earnings recessions have typically lasted 2-3 years, and, given the severity of the plunge in profits and the continued influence of the pandemic in the first half of 2021, it is likely that profits will not surpass their 2019 peak until 2022, at the earliest.

With most equity markets finishing the year at all-time highs despite economic conditions and corporate earnings that are still recovering, valuations are well above historical averages. For example, the forward P/E ratio for the S&P 500 at the beginning of 2021 was 22.3x, which compares to the 25-year average of 16.6x. Most other valuation metrics also suggest equity valuations are above average. The only valuation metric by which equities appear attractively valued is when comparing dividend/earnings yields relative to bond yields, meaning bonds are as expensive (or more) than stocks.

Key tenets of our investment strategy and process – ownership of high-quality companies and securities, diversification across asset classes, focus on long-term goals rather than short-term “noise”, emphasis on time in the market rather than timing the market – served us well during the tumultuous year of 2020. By maintaining our disciplined, thorough, fundamentally driven investment process we did not panic in response to the “ugly headlines” in the early days of the pandemic. Of course, in reflecting, we can always do better, and we continually strive to do that for you and for all our clients.

Given the strong returns generated over the past two years, we would not be surprised to see more muted returns in 2021. Also, given the mixed set of conditions described above, we expect volatility to remain elevated. In any case, as we discussed in our last quarterly letter, we think a well-diversified portfolio has never been more important considering the environment we are in today. We have increased the diversification of our portfolios recently by adding gold, silver and international investments, so we feel well positioned as we head into the new year.

As always, we appreciate the opportunity to serve you. Please do not hesitate to contact us with any questions.

2020 Year End Review PDF Download