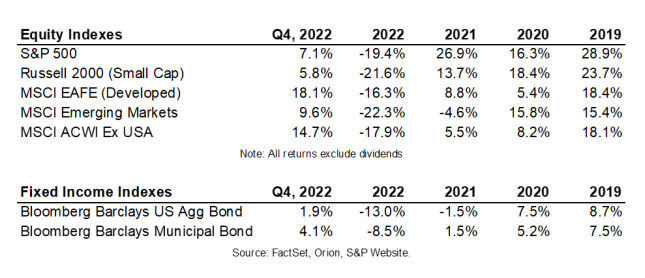

Each year on the last day of trading, the traders on the floor of the New York Stock Exchange close out the year by singing the song Wait Till The Sun Shines Nellie by Buddy Holly. The basic message of the song – look to the future, it’s going to be better – seems particularly relevant as we head into 2023 given that 2022 was one of the most difficult years on record for investors. U.S. stocks, as measured by the S&P 500, were down nearly 20% (excluding dividends) for the year, though they did recover meaningfully from their October lows during the fourth quarter. Many segments of the market performed even worse, including the tech-heavy Nasdaq Composite Index (down 33%), the Russell 2000 index of smaller U.S. companies (down 22%), and emerging market stocks (down 22%). In addition, U.S. bonds, as measured by the Bloomberg Barclays Aggregate Bond Index, were down 13% for the year. This was (by far) the worst performance for bonds in well over 50 years. Since 1976, the Bloomberg Aggregate bond index has generated negative returns only five times (1994, 1999, 2013, 2021 and 2022), and the largest annual decline prior to this year was 3% in 1994. So, a second consecutive year of declines in bonds including a 13% decline in 2022 is unprecedented. Moreover, during past years in which stocks have been down the most – 2022, 2008, 2000-2002, 1990 and 1981 – bonds generated positive returns and helped cushion the impact. That obviously did not happen last year, as bonds were down almost as much as stocks.

Although 2022 was difficult, it is important to consider that the three years (2019-2021) leading up to it were very favorable. Over those three years, the Bloomberg Aggregate bond index returned roughly 15% and the S&P 500 returned over 70%. Given markets are often volatile and driven by emotion in the short run, we emphasize taking a long-term view when investing. In that context, it is worth noting that a broadly diversified portfolio of stocks and bonds could have risen by 30% or more (depending on the mix of stocks and bonds) between the end of 2018 and the end of 2022. That type of annualized return –even after this year’s losses – would put many investors ahead of the game in their long-term plans.

Turning to the future, it is very clear to us that the economy is slowing down rapidly, and we think it is increasingly likely that the U.S. economy will slip into recession (if it hasn’t already). With the S&P 500 down more than 25% from its highs at one-point last year and the Nasdaq currently down over 30% from its highs, we believe we are currently navigating the 14 th bear market in the past 100 years.

These economic and market downturns are normal. Moreover, they serve the important purpose of removing excesses that are built up during the expansion phase of the cycle, thereby setting the stage for the subsequent recovery. We have seen examples of excesses being removed in several areas of the market already, including crypto, unprofitable technology/growth stocks, so-called meme stocks, and so on. We expect this will continue this year. From a timing standpoint, we note that most economic and equity market downturns last less than two years, and the market tends to lead the economy into the downturn and out of the recovery. The average duration of the 14 equity bear markets noted above was 20 months and only four lasted more than two years. Encouragingly, if this turns out to be a typical bear market, then we are already more than halfway through the downturn.

In assessing risk and reward from here, we would note that the median bear market decline has been 34%. The S&P 500 is currently down roughly 20% from its highs and was down more than 25% at certain points last year. That would suggest we have already experienced roughly two-thirds of an average decline, leaving downside risk from here in the 10-15 percentage point range (an S&P 500 in the low 3,000’s vs. 3,840 at year-end). History suggests that the economy and market will recover and break through to new highs. To be more specific, this is the ninth time the S&P 500 has declined 25% or more since 1950; the average 3-year return from that point in the first seven of those instances (the last two don’t have a three-year return yet) was 37%. If this pattern were to be repeated, the S&P 500 would be 37% higher than the October 2022 low of 3,583 by October 2025. That would imply a 4,900+ value for the S&P 500 which represents 28% upside from the year-end close of 3,840. Putting it all together, using history as a guide, we see further downside risk in the 10%-15% range and longer-term (3-year) upside of nearly 30%, which implies an upside-to-downside ratio of 2:1.

We view a 2:1 ratio of reward to risk as favorable. So, whereas we have spent much of last year shifting the portfolio to a more defensive stance (raising cash, reducing equity exposure, increasing portfolio weightings to defensive sectors), we are now planning to use the volatility we expect as we work through the second half of this bear market to get more aggressive. That will involve increasing equity exposure, reducing our cash position, shifting the portfolio toward more cyclical sectors, and buying some of the great companies that we have long followed but never owned because they always appeared to be ‘too expensive’. We expect this to be a gradual, methodical process of getting more aggressive, just as last year was a gradual process of getting more defensive. However, if the market experiences a sudden sell-off or drifts back toward an S&P 500 in the 3,500-3,600 range (which would imply a reward to risk ratio closer to 3:1) we would then seek to move more quickly and aggressively.

In the meantime, as we are monitoring developments in equities, we would note that the opportunity set in fixed income/bonds is the best it has been in over 10 years. At the beginning of last year, the yield on the 10-year Treasury bond was around 1.5%. By October, the 10-year Treasury yield rose nearly 300 basis points to 4.3% before finishing the year at 3.9%. The move at the short end of the curve was even more dramatic with the yield on the 2-year Treasury rising 367 basis points during the year to 4.4% at year-end.

In addition, the spread over treasuries for riskier bonds widened materially, meaning yields for investment grade corporate and high-yield bonds rose even more than for Treasuries. This dramatic rise in rates is

why bonds had such a bad year last year (as interest rates rise, bond prices fall and vice versa). However, as we start this year, the bond funds we own have a starting yield-to-maturity in the 6%-7% range. This means that if rates were to stay flat for the year, bond returns would be roughly in this 6%-7% range.

Moreover, since interest rates typically fall during recessions, we believe it is possible that the total return on bonds could approach 9% or 10%, as bond prices would rise as interest rates fall. This would be particularly useful in cushioning the negative impact equities might experience as economic conditions worsen. In a nutshell, we believe bonds are now in a much better position than last year to serve their historical role of providing income and stability (negative correlation to equities) in a balanced portfolio

In summary, we do believe prospects for future returns are much better after the reset we experienced last year. This is particularly true for bonds. With stocks, we expect continued volatility, and we acknowledge that things could get worse before they get better. But we continue to believe in the long-term outlook for stocks.

As always, please do not hesitate to reach out with any questions or concerns you may have regarding your individual investment portfolio.