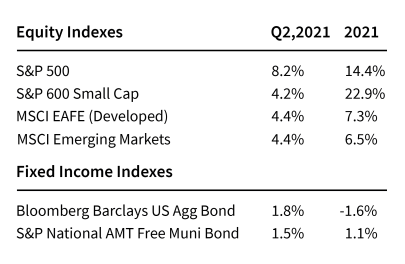

Financial markets followed through on recent momentum to generate strong returns for investors in the second quarter of 2021. Equity markets in the U.S. led the way once again with the S&P 500 index up 8.2% in the quarter (excluding dividends), while foreign stocks and the stocks of smaller U.S. companies were up a little over 4%. For the year, the S&P 500 is now up 14.4% and the S&P 600 is up nearly 23%. To provide longer-term context, U.S. stocks (S&P 500 index) are now up over 70% since the end of 2018 and have nearly doubled from the lows of the pandemic last March. U.S. bonds reversed some of the weakness experienced during the first quarter (the worst quarter for bonds in 40 years), as the Bloomberg Barclays Aggregate Bond Index gained 1.8% to bring the year-to-date return to -1.6%. The bond market was supported by a decline in the 10-year Treasury yield to 1.44% from a high of 1.77% at one point during the first quarter.

Strength in financial markets has been underpinned by the recovery in economic and financial conditions, as the negative impacts from the pandemic wane, the economy reopens more fully and the effects of fiscal and monetary accommodation gain momentum. Consensus expectations are for high-single-digit GDP growth and S&P 500 earnings are expected rise 50%+ to hit a new all-time high in 2021. These growth rates are admittedly helped by easy comparisons (for example, earnings were down over 20% last year), however such growth rates are well above recent long-term trends (2.5% GDP growth and 6% EPS growth) and reflect a very strong recovery from the pandemic induced recession. Equity market valuations remain relatively high (S&P 500 forward P/E ratio of 21.5x vs. 25-year average of 16.7x), however, earnings are likely to continue to grow quickly in the year ahead which should lead to some compression in these ratios.

In past quarterly letters, we have devoted a fair amount of attention to the risk of rising inflation and how we were positioning portfolios to protect against this risk. During the second quarter, key inflation indicators rose substantially due to a combination of factors including easy comparisons, the post-covid reopening, supply chain disruptions, rising commodity prices and the aggressive fiscal and monetary stimulus. This culminated in the May CPI (Consumer Price Index) report, which showed a 5% year-over-year change, which was ahead of expectations and well ahead of recent trends in the 2% range. Indeed, inflation has now become one of the most hotly debated topics in financial markets with some (including the Federal Reserve) seeing recent trends as ‘transitory’ and others worried about a return to the runaway inflation experience in the 1970s.

We believe the answer lies somewhere in the middle of these two extreme views. We would note that more than half of the total increase in CPI over the past two months has been due to used cars, rental cars, hotels, and airfares. These are small categories seeing large price jumps due to reopening and supply chain disruptions, both of which are temporary. Larger categories in the CPI basket such as rents and healthcare are exhibiting much more subdued growth rates (though we are monitoring the rent category closely as there are anecdotal signs of inflationary pressures building). Our base case assumption is that inflation will remain elevated relative to the recent past but that it will not get ‘out of control’ in the near term. As the economy continues to reopen, we expect supply chain disruptions to ease and demand to cool as the growth in money supply slows and the effect of fiscal stimulus subsides. So, while we remain focused on long-term inflationary risks due to highly aggressive fiscal and monetary policy frameworks, we think inflationary pressures are peaking in the near term, and we are adjusting our portfolios to reflect that view. For example, we recently reduced our exposure to Treasury Inflation Protected Securities (TIPS), which have significantly outperformed other fixed income categories over the past 18 months.

Looking ahead, assuming the current ‘emergency’ fiscal and monetary stimulus does not become a recurring policy feature, we believe this reopening/cyclical recovery will give way to the low-growth environment we were in pre-pandemic. In support of this view, we would note that year-over-year comparisons will become much tougher as we head into 2022. We also expect the impact of government stimulus to gradually diminish, and we think higher commodity prices, higher wage costs, higher interest rates and, potentially, higher corporate taxes will make further profit gains much more difficult to achieve. With growth slowing and equity valuations relatively high, we think equity market volatility will be higher as we head into the second half of the year. We would note that equity markets often experience corrections of 10% or more in the 2nd year of an economic expansion, so we would not be surprised to see such a pullback from current levels. On the other hand, outside of an exogenous shock (like Covid last year), almost every post-war recession was the result of a Federal Reserve rate hike cycle. Since the Fed is indicating that it will be on hold until 2023, we do not see the conditions for a sustained downturn in the economy or equity markets in the near term, so we would likely use such a correction as a buying opportunity.