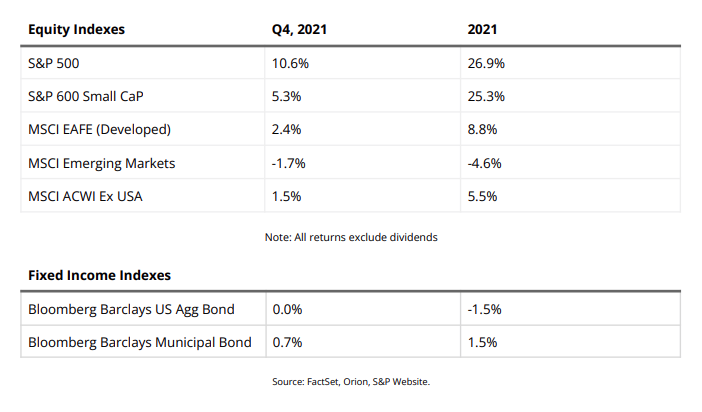

If you follow U.S. financial media, you might be surprised to know that financial markets turned in somewhat mixed results in 2021. U.S. equities, which dominate the news coverage, did indeed generate very strong returns in 2021. However, fixed income returns were flat-to-negative for the year and international stocks lagged the performance of U.S. stocks by a wide margin (over 20 percentage points). Indeed, as shown in the table below, developed market international stocks (MSCI EAFE index) were up 8.8% for the year, while emerging market stocks (MSCI Emerging Market index) were down 4.6%. Overall, foreign stocks (as measured by the MSCI ACWI Ex USA index) were up 5.5%. Meanwhile, U.S. stocks, as measured by the S&P 500 index, rose steadily throughout 2021, finishing the year up nearly 27% (excluding dividends) and hitting 70 all-time highs in the process – the largest number of new records for the benchmark index since 1954. Moreover, for the first time in history, all the sectors of the S&P 500

posted double-digit gains for the year.

The Covid pandemic and the government response to the pandemic have been the dominant drivers of both economic and market activity since March 2020. The economy and the market continue to be impacted in the short term by the ups and downs associated with the pandemic. However, the negative impact from the pandemic has been overwhelmed by the enormity of the political response, particularly in the U.S. For example, legislation passed in the last two fiscal years has added $5.3 trillion to the economy. In addition, the Federal Reserve lowered short-term interest rates to near zero and expanded its balance sheet by over $4.5 trillion since March 2020. This balance sheet expansion pumped normous liquidity into the system and helped hold down longer-term interest rates, further supporting economic activity. Adding a combined $10 trillion of monetary and fiscal stimulus to a $21 trillion (nominal GDP in 2020) U.S. economy has proven to be a powerful accelerant for the economic recovery. Indeed, nominal GDP is set to surpass $23 trillion in 2021, exceeding its pre-pandemic growth path and indicative of a full economic recovery. Corporate earnings have recovered spectacularly since the big declines in early 2020; S&P 500 operating earnings-per-share are now expected to rise over 45% to a new all-time high in 2021. Other countries/regions also provided stimulus, but the scale of the response was much smaller outside the U.S. We believe this is a big part of the reason the U.S. economy and the U.S. stock market have done so well, relative to the rest of the world.

As we look forward to 2022, there are several challenges and potential threats to consider. As we write this letter, we are in the middle of another Covid wave driven by the new Omicron variant. It is expected that this wave will rise and fall quickly, but if it proves to be more long-lasting it could have a negative, though temporary, impact on the economy as has been the case with prior waves. In addition, inflation has run hotter than policy makers expected, prompting the Fed to reverse course and accelerate the pace at which it withdraws its accommodative policies. The market now expects three rate hikes from the Fed this year. Six months ago, the Fed indicated that short-term rates would not rise until 2023. Although these rate hikes begin from very low levels, it is a key factor to monitor as almost every post-war recession was correlated with a Federal Reserve rate hike cycle. Finally, the fiscal stimulus which has been so supportive to markets is poised to drop sharply beginning in 2022. As just one example, the enhanced child tax credit, which has helped support overall strength in consumer spending was allowed to expire at the end of the year. So, while the economy should be much healthier than it has been over the past two years, it will also receive much less government support.

Although U.S. equities have had a strong run in 2021, to a large extent that performance was supported by the growth in earnings. At the end of 2021, the forward P/E ratio for the S&P 500 was 21x, down from 22x at the end of 2020. Valuations remain elevated by most measures (the 25-year average forward P/E ratio is closer to 17x) but do not appear extreme, especially considering the level of interest rates, and therefore the relatively low return potential offered by most fixed income securities. Based on a deeper analysis of the index, it is notable that the top 10 stocks in the S&P 500 now account for a record 30%+ of the index’s total market capitalization (the prior peak was 25% in the late 90’s) and the average forward P/E of the top 10 stocks is 33x vs. less than 20x for the other 490 companies. Moreover, as we discussed in our 3Q21 letter, international stocks have lagged the performance of U.S. stocks by a cumulative 275% over the last 14 years (the longest period of international underperformance on record), and the current forward P/E ratio of the MSCI ACWI Ex USA index is at a 33% discount to that of the S&P 500. Clearly investors have been increasingly crowding into a very narrow trade – the very large, mostly technology-related, U.S. companies. All ten companies are great businesses, and we own seven of the ten. However, they are all clearly expensive and several are extremely expensive, relative to the global opportunity set that is available to us as investors. Given their share of the overall market’s capitalization, we think the market appears more expensive than it really is, and we continue to find compelling investment opportunities outside of this narrow group.

In summary, given the strong returns generated over the past three years, we would not be surprised to see more muted returns in 2022. Economic and corporate fundamentals appear solid overall. However, as discussed above, the evolving pandemic, inflationary pressures, rising interest rates, the diminishing impact from fiscal stimulus, and elevated valuations could all serve as a headwind to further gains. We still favor stocks to bonds but expect more volatility going forward than we experienced last year. Although stocks have been the key driver of portfolio returns recently, we still think a well-diversified portfolio of uncorrelated assets has never been more important considering the uncertain environment we are in today.

Please do not hesitate to contact any members of our wealth management team if you have questions, comments or concerns you would like to discuss.

The Whitney & Company Team