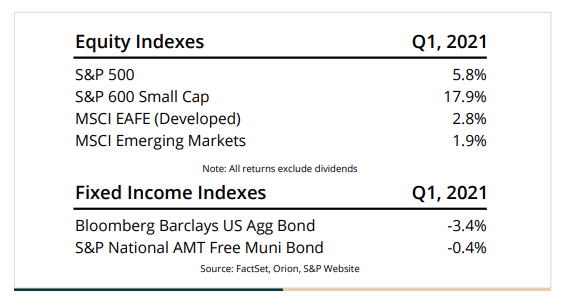

After one of the most volatile years in history, financial markets began 2021 in relatively quiet fashion. Equity markets around the world generated solid returns in the quarter. U.S. stocks, as measured by the S&P 500 index, were up 5.8% (excluding dividends), while developed and emerging international equities were up 2.8% and 1.9%, respectively. In a continuation of a trend that began in 4Q20, small company stocks materially outperformed the S&P 500, and after years of lagging the performance of growth stocks, so-called value stocks (stocks that trade at a lower price relative to corporate fundamentals such as revenue, earnings, and/or cash flow), led the way among both domestic and international indices. Since our investment approach focuses on more established, high quality companies and our valuation discipline emphasizes paying a reasonable price for growth, this shift in market sentiment has helped our relative performance. Probably the most notable development during the quarter was that the 10-year Treasury yield rose from 0.92% at the start of the year (which itself was up from 0.52% in August 2020) to as high as 1.77% before finishing the quarter at 1.74%. Since bond prices fall when interest rates rise, U.S. bonds, as measured by the Bloomberg Barclays Aggregate Bond Index, were down 3.4% for the first three months of the year. Hence, it was the worst quarter for bonds in 40 years.

Fixed income investments have historically played several roles in a balanced portfolio including steady income generation, diversification against equity volatility, and adding overall stability to the return profile of an investment portfolio. As we have discussed in prior letters, with interest rates falling to near generational lows, fixed income investments can be expected to generate less income and provide less of a cushion against equity volatility than in the past. However, we continue to value exposure to fixed income for the stability it provides; we think of it as a bit of an ‘insurance policy’ for the uncertainty we see on the horizon. Over the past year or so, we have responded to the changes in fixed income markets by expanding our holdings of emerging market bonds (which offer higher yields) and Treasury Inflation Protected Securities, or TIPS (which offer inflation protection). We also transitioned a portion of our fixed income investments into precious metals, which tend to perform well during periods of low (or negative) inflation-adjusted yields and during periods of aggressive monetary expansion, two conditions which are present today.

During the first quarter, we continued to evolve our fixed income approach to squeeze more yield/performance out of the opportunity set that is available today. Previously we used low-cost, passive ETF’s for our core fixed income investments. This gave us broad exposure to the investment grade portion of the U.S. bond market at a low cost and was intended to essentially deliver benchmark-like returns out of our core fixed income allocation.

Given that we think this market is largely picked over and not particularly attractive, we recently transitioned our core fixed income investments to a more active approach executed by third-party managers. The rationale behind this decision is that our research suggests that core fixed income is an area where active management is effective and has a history of outperforming industry benchmarks

To provide diversification, we have selected three core fixed income managers, and each has a slightly different strategy and approach. While the fees for the active managers are slightly higher than for the passive ETF’s, all three of the managers we have selected have demonstrated a consistent track record of outperforming the benchmark, net of fees. Indeed, two of the three managers have outperformed the benchmark in 9 of the last 10 years (the other did so in 8 of the last 10 years).

Economic and financial conditions continue to recover from the effects of the pandemic and the near-term outlook appears favorable. Fiscal and monetary policy continues to be highly accommodative. The U.S. government passed a $1.9 trillion stimulus package in March, less than three months after a $900 billion package. In addition, the Fed continues to hold short-term rates near zero and provide significant liquidity to financial markets. All this stimulus is poised to drive above average consumer spending, which should add substantially to short-term economic growth. Moreover, after peaking in January, confirmed cases of Covid-19 have declined precipitously and the acceleration of the vaccine roll-out should continue to bring the global health crisis under better control, enabling sectors of the economy that have been hardest hit by the pandemic to ‘reopen’ and drive economic growth once again. Longer term, there are several risks to consider. Overall debt levels are high and rising and demographics (aging populations) in most of the major economies remain poor. High levels of debt combined with poor demographics mean long-term economic growth potential is likely to remain subdued. In addition, there is a risk that the economy could overheat in response to all this stimulus with inflation and higher interest rates as a potential outcome. Given that low and falling interest rates have been a key underpinning for today’s relatively high asset valuations, rapidly rising interest rates is a clear source of vulnerability going forward.

As a result, we believe that maintaining a well-balanced portfolio through our disciplined investment approach will continue to provide the best strategy to achieve your financial goals.