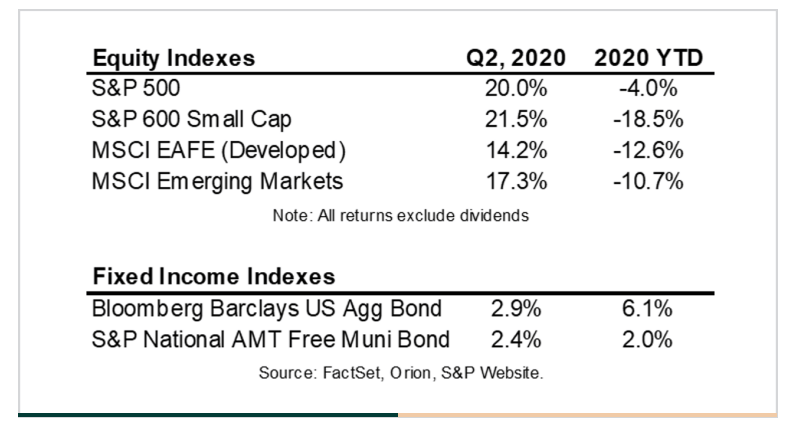

The first half of 2020 will go down in the books as an extraordinary time in modern history. A health pandemic has swept the globe, and the response to the pandemic has triggered a very deep recession with more people in the U.S. unemployed than at any time since the Great Depression. Markets have responded to these events with extreme volatility. After a very sharp correction in equities in the first quarter, markets staged a remarkable recovery with stocks, as measured by the S&P 500, in the second quarter to finish June down only %4 year-to-date.

However, you can see from the table above that the S&P 500 does not tell the entire story. Stocks of smaller companies (S&P 600 Small Cap) and foreign companies (MSCI EAFE and MSCI Emerging markets) also rallied significantly during the second quarter but remain well below levels at the beginning of the year. Dispersion of performance between sectors has also risen. For example, the technology sector is up 15% year-to-date, while Energy and Financials are down 35% and 24%, respectively. The only other sector that is positive for the year is consumer discretionary, and its performance has been largely driven by Amazon (considered by many to be a technology stock), which is up nearly 50% for the year. Moreover, these top five stocks in the S&P 500 (Microsoft, Apple, Amazon, Alphabet, and Facebook) now make up over 20% of the 500-company index; together these are up 25% year-to-date while the other 495 stocks are down almost 10% for the year. So, there has been a recovery, but if you exclude these five companies, the recovery has been more muted and perhaps more consistent with the challenges in the broader economy.

Fixed income markets also staged a recovery from the lows in late March, as the Fed’s easy monetary

policy (including direct purchase of bonds in various bond categories) combined with the economic

downturn to push 10-year Treasury yields below]% (Note: bond prices rise When interest rates fall). As

measured by the Barclay’s U.S. Aggregate Index, fixed income investments were up 2.9% in the second

quarter and are now up over 6% year—to-date. In the short run, this has provided investors with

surprisingly strong returns from bonds through June. However, it severely limits the income stream

provided by bonds going forward and heightens the risk of capital loss if rates rise in the future.

As we look forward, we would characterize the environment we find ourselves in today as a contest of two very powerful, opposing forces. On the one hand, we have the biggest economic contraction of the

modern era that was triggered by a virus that continues to affect consumer, business, and government behavior in unpredictable ways. This is a very powerful force. On the other hand, we have the largest-ever collective fiscal injection by countries around the world, including the United States, and a set of monetary policies that include ultra-low (or negative) interest rates, rapid debt monetization, and massive expansion of central bank balance sheets to print money and buy assets. These are highly inflationary policies. We believe the range of outcomes that could emerge from this contest are as wide as they have been in a long time, and the ability to forecast, with any certainty, the future path for the economy and markets will be challenging to say the least.

As a result, we think it is more important than ever to maintain a diversified portfolio of investments so that a portion of your portfolio is benefitting in any environment. For now, we think the odds tilt in favor of a more inflationary environment over the long run. An inflationary environment would favor equities relative to bonds, as well as other asset classes such as inflation-protected bonds (TIPS), gold, energy, emerging markets and real assets such as real estate. Most of our client portfolios are weighted more heavily toward equities, and we recently made several new investments in the aforementioned asset classes. If a more deflationary environment unfolds, it would favor cash and bonds relative to equities, particularly historical ‘safe-haven’ bonds such as U.S. Treasuries. We recently added an allocation to long-term Treasuries as a hedge against an equity market or economic relapse. Even though the yields on most investment-grade fixed-income instruments are low by historical standards, we continue to believe there is a place in client portfolios for such assets as they add stability, diversification and downside protection to a balanced investment portfolio.

Given heightened uncertainty and the wide range of potential economic and market outcomes as a result of the health pandemic, we don’t believe now is the time to make big moves. We think it is important to stick with your long-term plan. We invest predominately in high-quality companies that have strong balance sheets and are leaders in their industries. In our fixed-income portfolios, we emphasize investment-grade securities and largely avoid riskier bond categories. This is a purposeful approach that complements our emphasis on long-term investing because these types of investments are well positioned to survive difficult environments, thrive as conditions improve, and deliver competitive returns over the long-term.