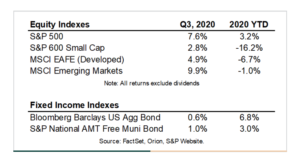

In the third quarter, equity markets continued their recovery from the March lows. US. stocks as measured by the S&P 500 index were up 7.6% in the quarter, bringing the year-to-date increase to 3.2%, excluding dividends. As shown in the table below, the stocks of foreign companies and smaller US. companies also moved higher during the quarter but remain negative for the year and well below prior highs. Dispersion of performance across sectors remains relatively high as the technology and consumer discretionary sectors (mostly driven by AMZN) are up 29% and 23% year-to—date, respectively, while the energy and financial services sectors are down 48% and 20%, respectively. Travel—related stocks such as hotels, cruise lines and airlines are all down more than 40% year-to-date. So, although the market as measured by the S&P 500 has made up significant ground in its recovery, there are large segments of the equity market that have yet to recover and are performing more ih-lihe With the challenges evident in the broader economy.

Fixed income markets were largely stable after big moves in the past two quarters. The lO-Year Treasury yield finished the quarter largely flat at 0.69%, the Fed Funds rate is near zero and the Federal Reserve has indicated that it plans to hold the Fed Funds rate at current levels through 2022. With rates across the maturity curve at historically low levels and credit spreads hear 20-year lows, fixed income returns going forward are likely to be materially lower than in the past.

Fundamentals underpinning recent market movements are currently mixed. The economy is clearly recovering from the dramatic: decline in activity beginning in March, but most data suggests it is still well below levels seen at the beginning of the year. For example, the US. has recovered roughly half of the 22 million jobs that were lost from the onset of the pandemic. The economy has been supported by unprecedented levels of fiscal and monetary government support. However, as some of those programs have begun to roll—off and the overall level of government stimulus has declined, there are numerous signs that the economic recovery is leveling off. The deep economic recession was accompanied by large declines in corporate earnings in the first half, as operating earnings declined 49% in TQ20 and 33% in 2Q20. Analysts are expecting profits to recover in 2021, but past earnings recessions have typically lasted 2-3 years, and given the severity of the plunge in profits and the gradual economic recovery, it is likely that profits will not surpass their 2019 peak until 2022. One notable positive is that interest rates are very low, which means that debt service for both consumers and corporations remains low, despite high absolute levels of debt. Since yields on (risk—free) government bonds are used as a discounting mechanism to value riskier assets, low interest rates also tend to increase prices on real estate and equity valuations. As a result, even though equity market valuations look expensive based on many traditional metrics (earnings, sales, cash flow etc.), investors may be willing tojustify higher valuations in the context of low rates, thereby creating a ‘wealth effect’ that helps support the economy.

One topic that is currently driving a lot of client questions is the election. Elections are notoriously accompanied by angst, anticipation and speculation. The resulting uncertainty tends to drive elevated market volatilityin the months leading up to an election. Fund-flow data from the past twenty years suggests that many investors raise cash during election years and 2020 fund-flow data suggests an extreme level of cash—hoarding has accompanied this election season. Our general view on this topic is that short-term election-related volatility should not disrupt Iong-term investment plans. One reason is that politics, and its impact, are very hard to predict and rarely play exactly to script. Moreover, the outcome of the election ultimately removes the associated uncertainty, eventually bringing the cash that was built up back into the market. Finally, history shows that the stock market has advanced regardless of the party in control. In the long run, we believe markets are driven by fundamentals, not politics.

As we discussed in our last quarterly letter, we see the current environment as a contest between powerful deflationary forces (a severe economic contraction and a health crisis with, as yet, no permanent solution) and equally powerful inflationary forces (unprecedented fiscal and monetary government stimulus). Economic conditions have clearly improved, but further improvement will likely require additional stimulus and a more permanent solution to the virus. We expect both will occur, but the timing is uncertain. In the near term, we expect elevated volatility and see a wide range of potential outcomes for both the economy and financial markets. In response, we continue to emphasize the importance of diversification and a long-term focus. We continue to favor high—quality equities over bonds but maintain an allocation to bonds for the stability and (albeit modest) income they provide to balanced portfolios. We have recently contemplated shifting a portion of your bond allocation to gold and silver investments. Like bonds, gold and silver have historically had a low correlation to equities, so this decision should add diversification and preserve stability for the overall portfolio. Gold and silver have also tended to perform well during periods of low (or negative) inflation-adjusted yields and during periods of aggressive monetary expansion. Both conditions are present today, so we also think gold and silver investments will generate higher returns than bonds in the near-to-intermediate term.

Please feel free to reach out to us if you have questions, comments or concerns you would like to discuss.

We have also recently updated our website at www.whitneyandconnpanycom.

Stay safe and healthy!