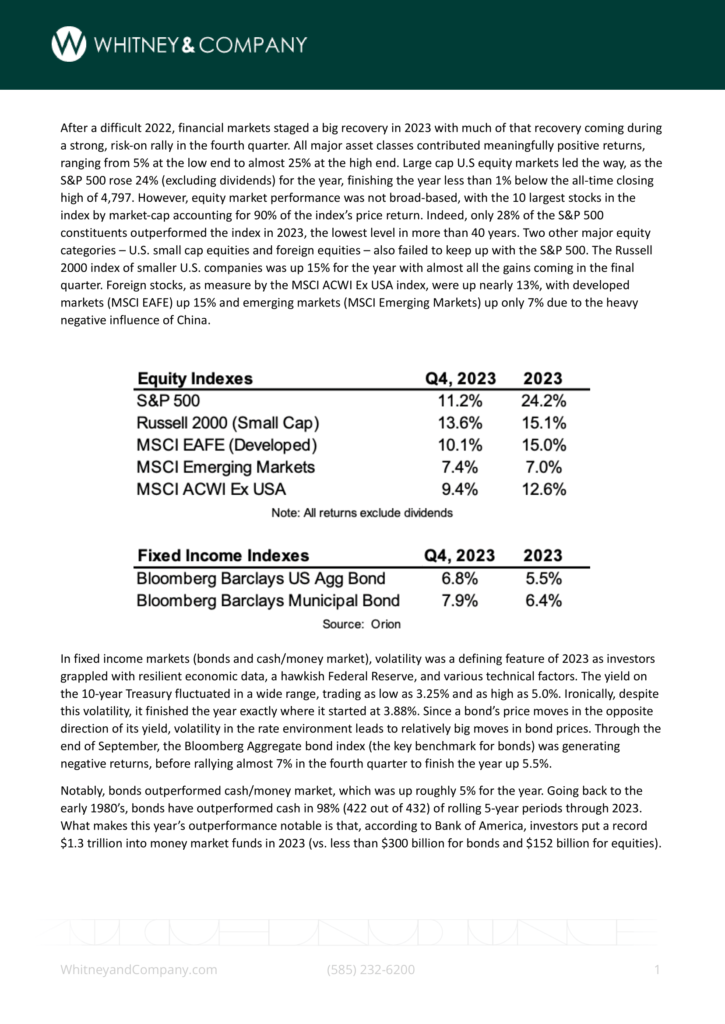

After a difficult 2022, financial markets staged a big recovery in 2023 with much of that recovery coming during a strong, risk-on rally in the fourth quarter. All major asset classes contributed meaningfully positive returns, ranging from 5% at the low end to almost 25% at the high end. Large cap U.S equity markets led the way, as the S&P 500 rose 24% (excluding dividends) for the year, finishing the year less than 1% below the all-time closing high of 4,797. However, equity market performance was not broad-based, with the 10 largest stocks in the index by market-cap accounting for 90% of the index’s price return. Indeed, only 28% of the S&P 500 constituents outperformed the index in 2023, the lowest level in more than 40 years. Two other major equity categories – U.S. small cap equities and foreign equities – also failed to keep up with the S&P 500. The Russell 2000 index of smaller U.S. companies was up 15% for the year with almost all the gains coming in the final quarter. Foreign stocks, as measure by the MSCI ACWI Ex USA index, were up nearly 13%, with developed markets (MSCI EAFE) up 15% and emerging markets (MSCI Emerging Markets) up only 7% due to the heavy negative influence of China.